Lower Mortgage Rates Are Fueling A Refinancing Revolution

The cost of borrowing is lower than it's been in more than a year. Giphy

Giphy

News that is entertaining to read

Subscribe for free to get more stories like this directly to your inboxThe average 30-year mortgage rate is now down to 6.47%, according to financial services giant Freddie Mac. That represents the second straight week the rate has dropped.

Sure, it’s still a lot higher than it was just a few years ago … but it’s also lower than it’s been at any point since May 2023. So it’s not surprising that those locked into a higher rate are now starting to weigh their options.

Borrowers react

A new report from the Mortgage Bankers Association highlighted the trend in a new report, revealing that:

- Its refinancing index is higher than it’s been since 2022

- The demand for refinanced mortgages spiked nearly 35% in just one week

- Compared to the same point last year, the index is up 118%

The motivation for refinancing is clear, considering the considerable sum each fraction of a percent can add to the cost of a mortgage over the course of its term. And Joel Kan, the chief economist for the Mortgage Bankers Association, noted that borrowers aren’t wasting any time trying to maximize their savings.

“Rates on both 30- and 15-year fixed rate mortgages decreased for the second consecutive week, and combined with the previous week’s rate moves, spurred another strong week for application activity as borrowers with higher rates took the opportunity to refinance,” he said.

The bigger picture

Falling mortgage rates can be seen as a good sign for the real estate market, if not the national economy in general.

Kan noted that there’s already some evidence that would-be home owners who felt they couldn’t afford to take the plunge in this market are starting to reconsider.

Purchase applications were up 3% over the past week, he noted, which is just one metric “indicating that prospective homebuyers are slowly re-entering the market.”

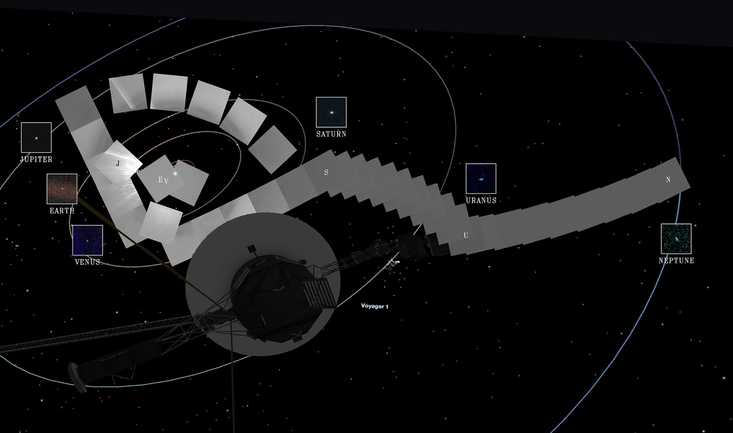

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned.

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned. One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right."

One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right." Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.

Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.