Green Energy Upgrades Are Paying Off In The Form Of Tax Credits

Legislators didn't think the incentives would be as popular as they have been.

News that is entertaining to read

Subscribe for free to get more stories like this directly to your inboxThe Inflation Reduction Act covered a variety of issues, many of which related directly to the promotion of environmental protection, i.e. cutting emissions and advancing renewable energy programs.

And one way the federal government sought to encourage such behavior was through the availability of tax credits. New reports show the initiative was even more popular than legislators anticipated.

$8 billion and counting

According to estimates released by the Joint Committee on Taxation, tax credits were expected to total about $2.4 billion during the first year and $4 billion in each of the two following years.

Last year alone, however, Americans claimed more than $8 billion in credits. Three-fourths of that money went toward the installation of solar panels, leaving about $2 billion for a host of other eco-friendly home renovations.

The average solar panel tax credit came in at about $5,000, which is enough to cover roughly 30% of the total cost. For many homeowners, the investment can pay off in just a few years through annual energy savings that can top $2,000.

While solar panels are by far the most common use of these Inflation Reduction Act subsidies, other household improvements can also save money while cutting emissions. Electric heat pumps, for example, can result in savings of up to $3,000.

Priming the pump

Even though some people would have invested in green renovations even without the incentive, analysts believe the promise of tax credits was enough to convince many who were on the fence to go ahead and take the plunge.

Nationwide, somewhere between 2% and 3% of U.S. taxpayers took advantage of the tax credit. Some states, including New Hampshire and Maine, saw participation at levels considerably higher than the national average.

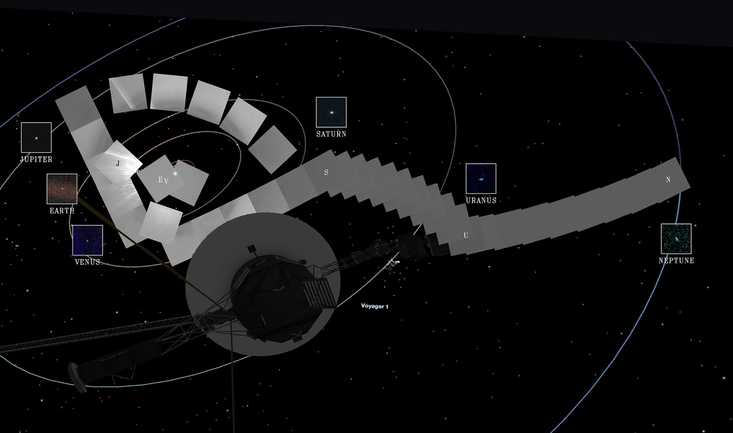

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned.

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned. One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right."

One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right." Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.

Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.