Trying To Determine The Value Of Your Home Can Create More Questions Than Answers

It's another source of confusion in a complex real estate market. Giphy

Giphy

News that is entertaining to read

Subscribe for free to get more stories like this directly to your inboxThe real estate market is in a prolonged state of uncertainty as both property values and interest rates remain high without any definitive evidence about when the trends will be reversing.

Another source of confusion comes from the various home valuation tools that never quite seem to be in agreement.

Identifying the main players

Some of the most popular platforms used to determine a rough estimate of a home’s value include those launched by Chase, Zillow, and Redfin.

On the surface, it might appear that all three use practically the same method of coming up with an estimated value. Each one factors in information provided by users as well as figures about the property that are publicly available.

But if you’ve used more than one in hopes of determining how much your home is worth, the process likely resulted in vastly different numbers.

Like other online platforms, internal algorithms and other tightly guarded company secrets contribute to these discrepancies … so it all adds up to little more than a guessing game for prospective sellers and buyers.

Figuring it out yourself

As the owners of one Chicago home recently found out, the difference between home valuation tools can be more than $120,000. So what are you supposed to do?

If you’re selling a home, try to make smart upgrades and improvements that will add even more value than the money you’ll spend completing them. And if you’re looking for a home, rely on a professional real estate agent as well as a combination of estimates you can find online.

There is one tool that seems to be more accurate than the rest. That’s because Realtor.com doesn’t only rely on its own model, but receives input from a trio of partnering companies to create a comprehensive estimate.

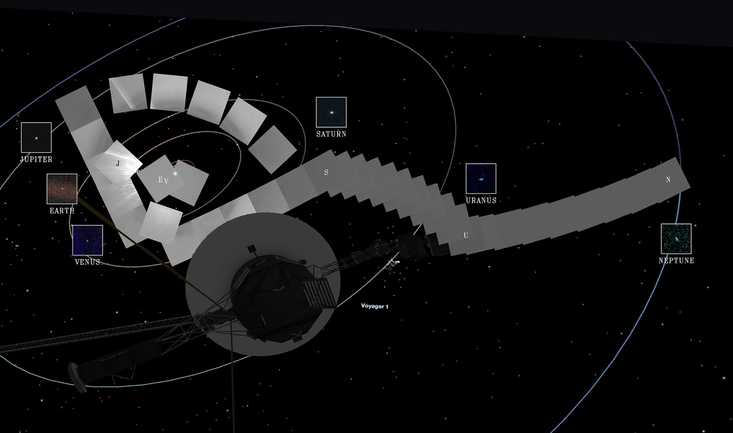

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned.

Why Is The Aging Voyager 1 Probe Sending Back Incoherent Communications?

It's been speaking gibberish for a few months and officials are concerned. One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right."

One Woman’s Massive Donation Is Wiping Out Tuition At This Medical School

Her inheritance came with the instruction to do "whatever you think is right." Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.

Woman’s Pets Will Inherit Her Multimillion-Dollar Fortune, Not Her Kids

It's not the first time four-legged heirs were named in a will.